Insurance Planning

Insurance planning is an essential component of financial planning that facilitates the protection of people and families against monetary losses that may be incurred as a result of unanticipated occurrences. The process includes assessing potential dangers, choosing suitable insurance plans, and making certain that enough coverage is obtained. The following is a list of the essential aspects and factors to consider while arranging for insurance:

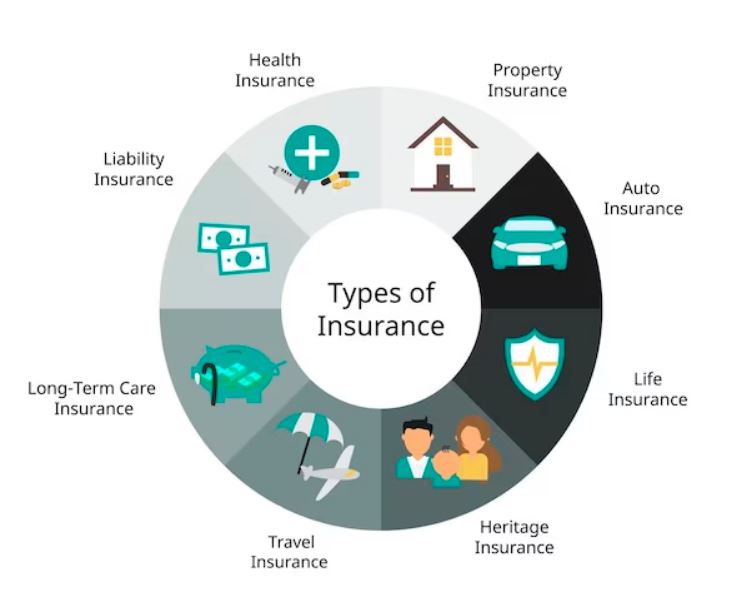

Types of Insurance

- Life Insurance

- Health Insurance

- Disability Insurance

- Long-Term Care Insurance

- Homeowners/Renters Insurance

- Auto Insurance

- Umbrella Insurance

Key Considerations in Insurance Planning

1. Assessing Risks

Prioritize Coverage: Find out which dangers are the most serious, and then prioritize coverage in accordance with those threats.

Identify Potential Risks: Consider the monetary repercussions that might result from a number of different hazards, including death, incapacity, disease, damage to property, and liability.

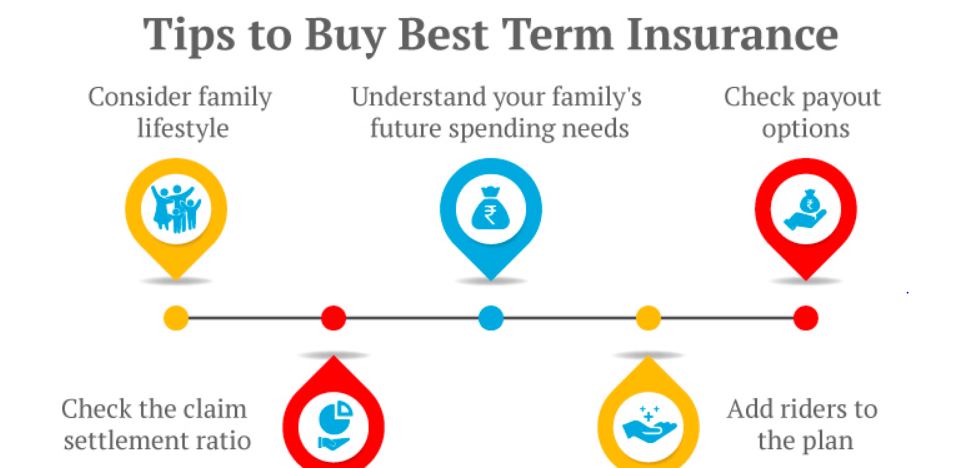

2. Choosing the Right Policies

- When comparing plans, it is important to take into consideration the coverage limitations, exclusions, premiums, and extra benefits.

- Reputation of the company: When selecting an insurance company, look for one that has a solid financial rating and excellent customer service.

- The cost of premiums should be weighed against the degree of coverage and benefits that are offered in order to conduct a cost-benefit analysis.

3. Determining Coverage Needs

Life Insurance: Determine the amount of coverage that is required by taking into account the replacement of income, the repayment of debt, the financing of school, and any other financial commitments.

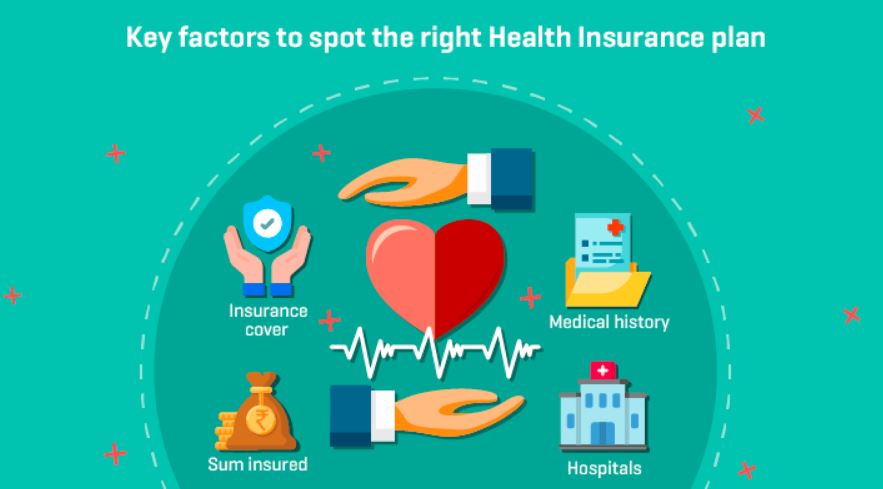

Health Insurance: Think about your medical history, the health history of your family, and any prospective healthcare requirements.

Property Insurance: Determine the worth of your house and the items you own, and make sure that the coverage you have is equal to the cost of replacing them.

Disability Insurance: Make certain that the coverage is enough to replace a sizeable amount of your income.

4. Reviewing and Updating Coverage

Regular Reviews: Review your insurance plans on an annual basis to verify that they continue to fulfill your requirements and make any required adjustments to your coverage.

Life Changes: In the aftermath of significant life events, such as getting married, having a kid, or purchasing a house, it is important to update your insurance coverage.

5. Estate Planning Considerations

- Beneficiary Designations: Check to see that the beneficiary designations on your retirement accounts and life insurance policies are up to date.

- Use of trusts: When it comes to managing and distributing the profits from life insurance, you may want to consider utilizing trusts.

Tips for Effective Insurance Planning

Emergency Fund: For the purpose of covering deductibles and other out-of-pocket expenditures that are not covered by insurance, you should save an emergency fund.

Read the Fine Print: It is important to have a thorough understanding of the claims procedure, as well as the coverage limitations and exclusions that are included in each policy.

Bundle Policies: When you purchase numerous insurance plans from the same provider, you may discover that you are eligible for savings.

Work with a Professional: Think about getting the assistance of a financial planner or an insurance expert to assist you in determining your requirements and choosing the suitable coverage.

Conclusion

The process of arranging for insurance is a vital component of an all-encompassing financial strategy. The ability to protect yourself and your loved ones from the financial difficulties that are brought on by unforeseen occurrences may be achieved via the process of evaluating risks, calculating coverage requirements, and choosing suitable policies. Your insurance coverage should be reviewed and updated on a regular basis to ensure that it continues to meet your continuously changing requirements.

Read also:- Green Investments, Example, Energy Efficiency, Renewable Energy, Green Bonds.

Hi, I’m Narinder Kumar, founder of BlogsBuz.com. I create articles and generate celebrity biographies, providing verified, up-to-date content. As an SEO expert and online tools creator, I also share practical tips on making money online, finance management, blogging, and passive income. My mission is to provide accurate information and keep you away from fake content, ensuring you stay well-informed and make smart decisions online.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

🌟 Welcome to BlogsBuz.com! 🎉

Your one-stop destination for the hottest celebrity updates, viral entertainment buzz, and exclusive behind-the-scenes stories you won’t find anywhere else! 🔥

Blogs Buz website have any no issue check your internet connection and after that you are face any issue to tell me. I am solve the website issue Quickly.

👉 Don’t miss out! Subscribe today and turn on notifications to get instant updates on every new post, trending topic, and breaking entertainment story.

💌 Loving our content? Spread the word! Share BlogsBuz.com with your friends and help us become the world’s #1 hub for celebrity fans and entertainment lovers. 🚀

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

🌟 Welcome to BlogsBuz.com! 🎉

Your go-to destination for the latest celebrity updates, trending entertainment stories, and exclusive behind-the-scenes moments — all in one place! 🔥

👉 Stay in the Loop!

Never miss a new post, viral trend, or breaking entertainment update — subscribe now and turn on notifications!

💌 Enjoy Our Content?

Show your support! Share BlogsBuz.com with your friends and help us grow into the world’s #1 spot for entertainment lovers. 🚀